From the largest smartphone manufacturer, Nokia has now become one of the manufacturers struggling to stay relevant in a market in which Apple and Samsung apparently collect over two thirds of the entire industry's profit. You all know that Apple has an extremely high profit from the sale of iDevices and this practically helps them to invest in the development of new technologies, but this also helped them to collect no less than 110 billion in accounts and investments worldwide.

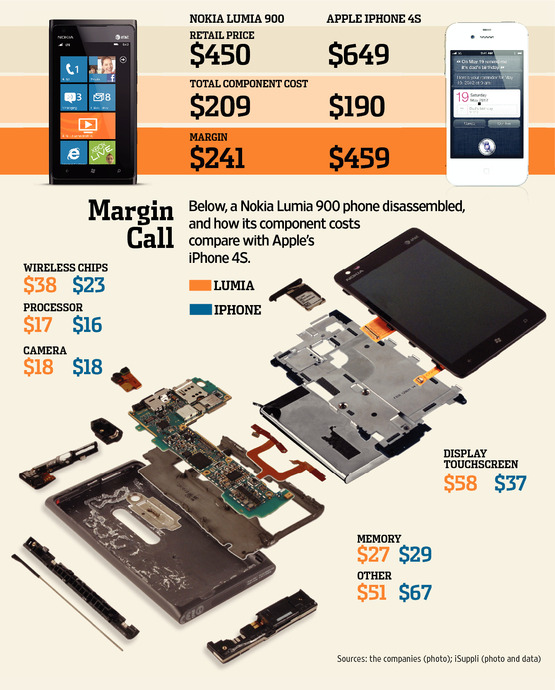

To demonstrate the problems Nokia is going through, those from Wall Street Journal made the graph above in which we have a comparison between iPhone 4S and Nokia Lumia 900. The prices are expressed in dollars, they differ in other areas of the globe, but even so we can get an idea about the final price ratio> component cost>final margin. Practically, the Nokia Lumia 900 is $200 cheaper than the iPhone 4S, but Nokia pays $20 more for components and loses $218 of the final margin that should go into its accounts.

Apple remains with $459 after the sale of an iPhone, if we exclude the price of components, but Nokia remains with only $241 and the difference is enormous. This money does not represent profit, but is used to pay for assembly, distribution, software development, etc., and at the end each company remains with a certain profit, which is higher in the case of Apple. Nokia is forced to sell terminals at low prices in order to remain competitive, but this affects it in the long term because it loses a lot of money.