ING Bank has taken an extremely important measure for customers from all over Romania, one that many of them should know about. We are talking about a measure that is implemented after the Romanian Government decided to adopt an emergency ordinance for the suspension of credit installment payments.

ING Bank allows customers to do this based on GEO 90/2022, and now that there are also methodological rules for application, it has details for customers. On the bank's website there is all the important information about what it means to use this system, but also what effects it will have in the long term.

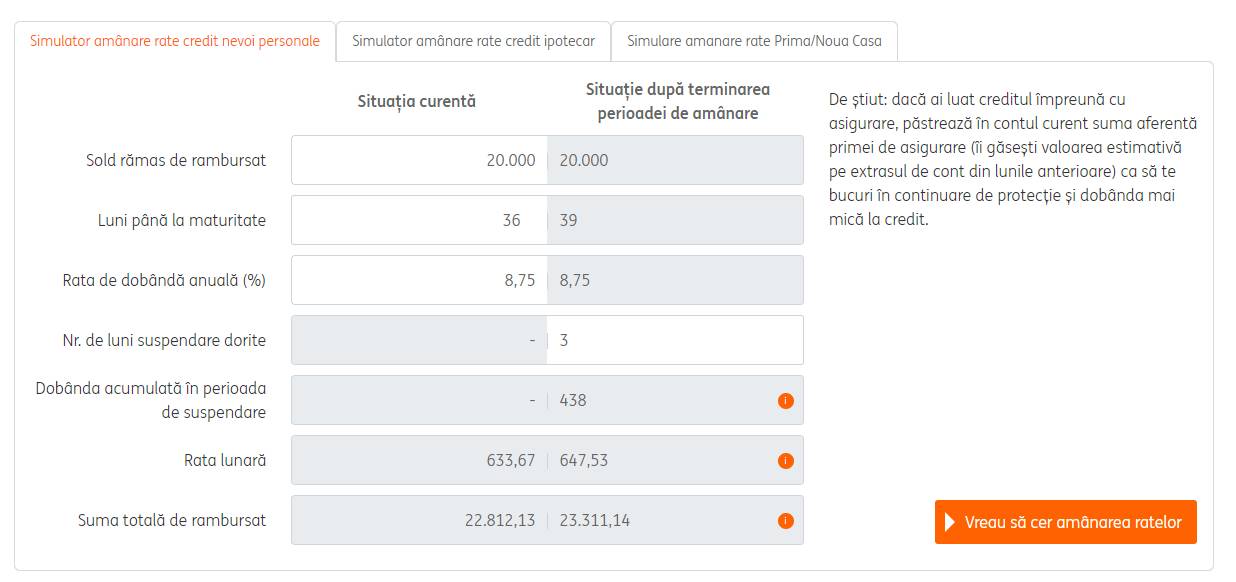

To begin with, the people from ING Bank have created a special calculator that allows us to find out what kind of impact the postponement of loan installments will have. Before deciding, or not, if you want to take advantage of this facility, you can find out how your credit will be affected by this operation, and how the credit rates will change, in the end.

ING Bank: New IMPORTANT Measure Taken for Romanian Customers

ING Bank has separate simulators for loans for personal needs, for mortgage loans, or loans for the First/New House. Practically, many of the clients in Romania who have a loan taken from the bank will have the possibility to postpone the installments, if they come to the conclusion that this measure is good for them.

The suspension of the payment of bank installments can only be done in the case of Romanians who were affected by the energy crisis, or by the war situation in Ukraine. ING Bank explains this very clearly in the website where it has information about this emergency ordinance, just like the other banks in Romania that grant this facility.

ING Bank explains very clearly on its website the conditions under which anyone can take advantage of this system, so it is good to know everything in advance. Not everyone will be able to suspend the payment of installments for loans, and not under any conditions, so it is good to inform yourself correctly before making a decision vis-à-vis everything.

ING Bank is not the only bank where we see measures of this kind, so if you have a loan with another bank, it is good to look at the information it provides for this process.