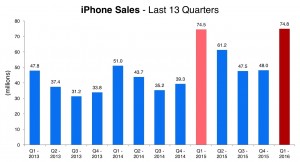

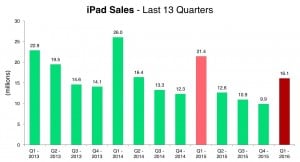

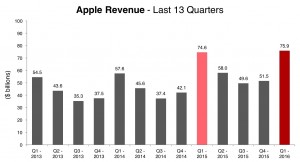

74.8 milioane de iPhone, 16.1 milioane de iPad si 5.31 milioane Mac-uri au fost vandute in T4 2015, T1 2016 in anul fiscal al Apple, de catre compania Apple, ele generand incasari de 75.9 miliarde de dolari si profit de 18.4 miliarde de dolari.

Pentru Apple acesta este cel mai bun trimestru fiscal din istoria companiei, insa in T4 2014 compania americana a vandut 74.4 milioane de terminale iPhone, 21.4 milioane de tablete iPad si 5.5 milioane de Mac-uri, incasand 74.6 miliarde de dolari cu profit de 18 miliarde de dolari.

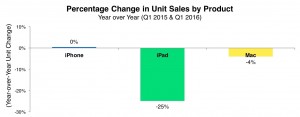

Practic, vorbim despre o crestere de 0.4 milioane de unitati in vanzarile de terminale iPhone, o scadere de 4.3 milioane de unitati in vanzarile de tablete iPad si de o scadere de 0.18 milioane de unitati in vanzarile de Mac-uri.

Incasarile au crescut cu 1.3 miliarde de dolari, in timp ce profitul este cu doar 0.4 miliarde de dolari mai mare, iar aceste lucruri vor genera cu siguranta foarte multa neliniste in randul analistilor americani.

Desi rezultatele financiare ale companiei Apple nu sunt spectaculoase, vorbim totusi despre cel mai bun trimestru fiscal din istoria companiei si despre o crestere marginala a vanzarilor de terminale iPhone, chiar daca tabletele iPad si Mac-urile au inregistrat scaderi.

Analistii americani prezic de saptamani de zile faptul ca Apple se indreapta spre un prim trimestru fiscal cu scaderi in vanzarile de iPhone-uri, iar acest ar putea veni in T1 2016, T2 2016 pentru Apple.

Apple Reports Record First Quarter Results

IPHONE, APPLE WATCH, SERVICES & APPLE TV DRIVE ALL-TIME RECORD REVENUE

RESULTS PRODUCE RECORD QUARTERLY PROFIT OF $18.4 BILLION

CUPERTINO, California — January 26, 2016 — Apple® today announced financial results for its fiscal 2016 first quarter ended December 26, 2015. The Company posted record quarterly revenue of $75.9 billion and record quarterly net income of $18.4 billion, or $3.28 per diluted share. These results compare to revenue of $74.6 billion and net income of $18 billion, or $3.06 per diluted share, in the year-ago quarter. Gross margin was 40.1 percent compared to 39.9 percent in the year-ago quarter. International sales accounted for 66 percent of the quarter’s revenue.

“Our team delivered Apple’s biggest quarter ever, thanks to the world’s most innovative products and all-time record sales of iPhone, Apple Watch and Apple TV,” said Tim Cook, Apple’s CEO. “The growth of our Services business accelerated during the quarter to produce record results, and our installed base recently crossed a major milestone of one billion active devices.”

“Our record sales and strong margins drove all-time records for net income and EPS in spite of a very difficult macroeconomic environment,” said Luca Maestri, Apple’s CFO. “We generated operating cash flow of $27.5 billion during the quarter, and returned over $9 billion to investors through share repurchases and dividends. We have now completed $153 billion of our $200 billion capital return program.”

Apple is providing the following guidance for its fiscal 2016 second quarter:

- revenue between $50 billion and $53 billion

- gross margin between 39 percent and 39.5 percent

- operating expenses between $6 billion and $6.1 billion

- other income/(expense) of $325 million

- tax rate of 25.5 percent

Apple’s board of directors has declared a cash dividend of $.52 per share of the Company’s common stock. The dividend is payable on February 11, 2016, to shareholders of record as of the close of business on February 8, 2016.

Apple will provide live streaming of its Q1 2016 financial results conference call beginning at 2:00 p.m. PST on January 26, 2016 at www.apple.com/investor/earnings-call/. This webcast will also be available for replay for approximately two weeks thereafter.

Q1’16 Earnings Supplemental Material

This press release contains forward-looking statements including without limitation those about the Company’s estimated revenue, gross margin, operating expenses, other income/(expense), and tax rate. These statements involve risks and uncertainties, and actual results may differ. Risks and uncertainties include without limitation the effect of competitive and economic factors, and the Company’s reaction to those factors, on consumer and business buying decisions with respect to the Company’s products; continued competitive pressures in the marketplace; the ability of the Company to deliver to the marketplace and stimulate customer demand for new programs, products, and technological innovations on a timely basis; the effect that product introductions and transitions, changes in product pricing or mix, and/or increases in component costs could have on the Company’s gross margin; the inventory risk associated with the Company’s need to order or commit to order product components in advance of customer orders; the continued availability on acceptable terms, or at all, of certain components and services essential to the Company’s business currently obtained by the Company from sole or limited sources; the effect that the Company’s dependency on manufacturing and logistics services provided by third parties may have on the quality, quantity or cost of products manufactured or services rendered; risks associated with the Company’s international operations; the Company’s reliance on third-party intellectual property and digital content; the potential impact of a finding that the Company has infringed on the intellectual property rights of others; the Company’s dependency on the performance of distributors, carriers and other resellers of the Company’s products; the effect that product and service quality problems could have on the Company’s sales and operating profits; the continued service and availability of key executives and employees; war, terrorism, public health issues, natural disasters, and other circumstances that could disrupt supply, delivery, or demand of products; and unfavorable results of legal proceedings. More information on potential factors that could affect the Company’s financial results is included from time to time in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s public reports filed with the SEC, including the Company’s Form 10-K for the fiscal year ended September 26, 2015, and its Form 10-Q for the fiscal quarter ended December 26, 2015 to be filed with the SEC. The Company assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.