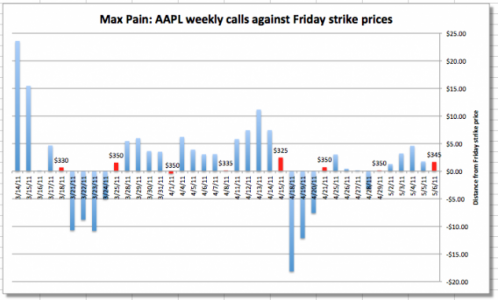

Revista Fortune Magazine are un articol foarte interesant despre o modalitate prin care actiunile companiei Apple sunt manipulate pe bursa americana. Ei sustin ca in ultimele 2 luni in fiecare zi de vineri actiunile companiei Apple inregistreaza o crestere sau o scadere mare chiar inainte de inchiderea bursei. Ei sustin ca in spatele acestor miscari ar fi diverse persoane care nu ar avea interese prea “bune” vis-a-vis de companie. Cei de la Fortune explica un ultim eveniment in care actiunile Apple erau vandute in pachete de cate 100 cu 350$ bucata ar fi scazut sub aceasta valoare inainte de inchiderea bursei in urma unei tranzactii foarte mari.

It was 3:48 p.m. on Friday April 29 and traders who had purchased Apple (AAPL) April 29 $350 “calls” — options that gave them the right to buy Apple shares in blocks of 100 for $350 per share — were sitting pretty. The stock was trading around $353.50 and those calls were worth more $350 apiece (the difference between the price of the stock and the so-called “strike price” of the option times 100).

Then, in an extraordinary burst of trading — exacerbated by the rebalancing of the NASDAQ-100 scheduled for the following Monday — more than 15 million shares changed hands and the stock dropped below the $350 strike price just before the closing bell. Result: The value of those calls disappeared like a puff of smoke.

Cei de la Fortune explica o teorie care pune intr-o lumina destul de proasta bursa americana dar si compania Apple, in final. Problema aceasta nu numai ca este ilegala in SUA dar creeaza o stare de nesiguranta pentru investitori iar asta ar putea afecta intr-o foarte mare masura pretul actiunilor la bursa.